Search Results: Returned 19 Results, Displaying Titles 1 - 19

-

-

2011., Alfred A. Knopf Call No: 330.973 M183a Edition: 1st ed. Availability:1 of 1 At Your Library Summary Note: A chronicle of the events that led to the current economic troubles cites the promotion of the idea that self-interest guides society more effectively than community concerns, and traces the roles played by a few powerful individuals.

-

-

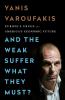

2016., The Bodley Head Call No: 330.94 V323a Availability:1 of 1 At Your Library Summary Note: ""The strong do as they can and the weak suffer what they must." --Thucydides The fate of the global economy hangs in the balance, and Europe is doing its utmost to undermine it, to destabilize America, and to spawn new forms of authoritarianism. Europe has dragged the world into hideous morasses twice in the last one hundred years... it can do it again. Yanis Varoufakis, the former Finance Minister of Greece, shows here that the Eurozone is a house of cards destined to fall without a radical change in direction. And, if the European Union falls apart, he argues, the global economy will not be far behind. Once America abandoned Europe in 1971 from the dollar zone, Europe's leaders decided to create a monetary union of 18 nations without control of their own money, without democratic accountability, and without a government to support the Central Bank. This bizarre economic super-power was equipped with none of the shock absorbers necessary to contain a financial crisis, while its design ensured that, when it came, the crisis would be massive. When disaster hit in 2009, Varoufakis argues that Europe turned against itself, humiliating millions of innocent citizens, driving populations to despair, and buttressing a form of bigotry unseen since the Second World War. Here, Varoufakis offers concrete policies that the rest of the world can take part in to intervene and help save Europe from impending catastrophe, and presents the ultimate case against austerity. With passionate, informative, and at times humorous prose, he warns that the implosion of an admittedly crisis-ridden and deeply irrational European capitalism should be avoided at all cost"--

-

-

2016, p2015, Adult, Paramount Call No: DVD Fic Big S Availability:1 of 1 At Your Library Summary Note: Four men who predicted the mid-2000s financial crisis attempt to make it big by using the "credit default swap" innovation.

-

-

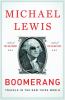

c2010., W. W. Norton & Co. Call No: 330.973 L675b Availability:1 of 1 At Your Library Summary Note: The author examines the causes of the U.S. stock market crash of 2008 and its relation to overpriced real estate, bad mortgages, shareholder demand for excessive profits, and the growth of toxic derivatives.

-

-

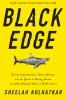

[2017], General, Random House Call No: 364.16 K81b Edition: First edition. Availability:1 of 1 At Your Library Summary Note: "Steven A. Cohen is a Wall Street legend. Born into a middle class family in a decidedly upper class suburb on Long Island, he was unpopular in high school and unlucky with girls. Then he went off to Wharton, and in 1992 launched the hedge fund SAC Capital, which grew into a $15 billion empire. He cultivated an air of mystery and reclusiveness -- at one point, owned the copyright to almost every picture taken of him -- and also of extreme excess, building a 35,000 square foot house in Greenwich, flying to work by helicopter, and amassing one of the largest private art collections in the world. But on Wall Street, he was revered as a genius: one of the greatest traders who ever lived. That public image was shattered when SAC Capital became the target of a sprawling, seven-year criminal and SEC investigation, the largest in Wall Street history, led by an undermanned but determined group of government agents, prosecutors, and investigators. Experts in finding and using "black edge" (inside information), SAC Capital was ultimately fined nearly $2 billion -- the largest penalty in history -- and shut down. But as Sheelah Kolhatkar shows, Steven Cohen was never actually put out of business. He was allowed to keep trading his own money (in 2015, he made $350 million), and can start a new hedge fund in only a few years. Though eight SAC employees were convicted or pleaded guilty to insider trading, Cohen himself walked away a free man. Black Edge is a riveting, true-life thriller that raises the troubling question: Are Wall Street titans like Steven Cohen above the law?"--From publisher.

-

-

2011., General, W.W. Norton & Company Call No: 330.9 L675b Edition: 1st ed. Availability:1 of 1 At Your Library

-

-

c2006., W. W. Norton & Company Call No: 332.11 G815h Edition: 1st American ed. Availability:1 of 1 At Your Library

-

-

-- Inside story of the collapse of Lehman Brothers.c2009., Crown Business Call No: 332.6 M478c Availability:1 of 1 At Your Library

-

-

2012., Melville House Call No: 336.34 G73d Availability:1 of 1 At Your Library Summary Note: Here anthropologist David Graeber presents a reversal of conventional wisdom. He shows that for more than 5,000 years, since the beginnings of the first agrarian empires, humans have used elaborate credit systems to buy and sell goods that is, long before the invention of coins or cash. It is in this era, Graeber argues, that we also first encounter a society divided into debtors and creditors. --.

-

-

2016., W.W. Norton & Company, Inc. Call No: 332.494 S854e Edition: First edition. Availability:1 of 1 At Your Library Summary Note: Discusses how the 2008 financial crisis revealed the shortcomings of the euro and how it has caused Europe's economic stagnation, and outlines three possible plans for moving forward.

-

-

By Fein, Louise2021., William Morrow, an imprint of HarperCollinsPublishers Call No: Fic Fei Edition: First edition. Availability:1 of 1 At Your Library Summary Note: Eleanor and Edward have wealth, status, and a happy marriage. But the 1929 financial crash is looming, and they're harboring a terrible, shameful secret. How far are they willing to go to protect their charmed life--even if it means abandoning their child to a horrific fate?"

-

-

-- Arnaque en talons2019., Adult, 110, Universal Pictures Home Entertainment Call No: DVD Fic Hustlers Availability:1 of 1 At Your Library Summary Note: Inspired by a true story, Hustlers follows Destiny, a young stripper struggling to make ends meet. That is, until she meets Ramona, the club's savvy top earner, who shows her the way toward making big bucks. But when the 2008 economic collapse hits their Wall Street clientèle hard, Destiny and Ramona concoct a plan with their fellow strippers to turn the tables on these greedy power players in this wild, modern-day Robin Hood.

-

-

(2011), Sony Pictures Home Entertainment Call No: DVD 338.5 I59i Availability:1 of 1 At Your Library Summary Note: Provided is an analysis of the global financial crisis of 2008, which at a cost over $20 trillion, caused millions of people to lose their jobs and homes in the worst recession since the Great Depression, and nearly resulted in a global financial collapse. Through exhaustive research, and extensive interviews with key financial insiders, politicians, journalists, and academics, traces the rise of a rogue industry which has corrupted politics, regulation, and academia.

-

-

c2014., Adult, Crown Publishers Call No: 338.5 G312s Edition: First edition. Availability:1 of 1 At Your Library Summary Note: "As president of the Federal Reserve Bank of New York and then as President Barack Obama's secretary of the Treasury, Timothy F. Geithner helped navigate the worst financial crisis since the Great Depression, from boom to bust to rescue to recovery. In this memoir, he takes readers behind the scenes of the crisis, explaining the hard choices and politically unpalatable decisions he made to repair a broken financial system and prevent the collapse of the Main Street economy. How a small group of policy makers -- in a thick fog of uncertainty, with unimaginably high stakes -- helped avoid a second depression but lost the American people doing it. Geithner takes readers inside the room as the crisis began, intensified, and burned out of control, discussing the most controversial episodes of his tenures at the New York Fed and the Treasury, including the rescue of Bear Stearns; the harrowing weekend when Lehman Brothers failed; the searing crucible of the AIG rescue as well as the furor over the firm's lavish bonuses; and the battles inside the Obama administration. Geithner also describes the aftershocks of the crisis, including the administration's efforts to address high unemployment, a series of brutal political battles over deficits and debt, and the drama over Europe's repeated flirtations with the economic abyss. How America withstood the ultimate stress test of its political and financial systems"--Provided by publisher.

-

-

By Roose, Kevin2014., Adult, Grand Central Pub. Call No: 332.64 R781y Edition: 1st ed. Availability:1 of 1 At Your Library Summary Note: "Becoming a young Wall Street banker is like pledging the world's most lucrative and soul-crushing fraternity. Every year, thousands of eager college graduates are hired by the world's financial giants, where they're taught the secrets of making obscene amounts of money-- as well as how to dress, talk, date, drink, and schmooze like real financiers. [This title] is the inside story of this well-guarded world. Kevin Roose, New York magazine business writer and author of the critically acclaimed The Unlikely Disciple, spent more than three years shadowing eight entry-level workers at Goldman Sachs, Bank of America Merrill Lynch, and other leading investment firms. Roose chronicled their triumphs and disappointments, their million-dollar trades and runaway Excel spreadsheets, and got an unprecedented (and unauthorized) glimpse of the financial world's initiation process."--Book jacket.

![The big short [DVD] (2015). Directed by Adam McKay. The big short [DVD] (2015). Directed by Adam McKay.](/Library/images/cover/noimage.png)

![Hustlers [DVD] (2019). Directed by Lorene Scafaria. Hustlers [DVD] (2019). Directed by Lorene Scafaria.](/Library/images/~imageCT100832.JPG)